Contactless payments are a prominent area of technological innovation today and a strong fintech trend. However, this is only the beginning of the transition to the digital dollar, as banks, credit card companies, and fintech firms work tirelessly to develop new technologies to address rapidly changing market conditions and evolving consumer behavior.

This is especially important in post-pandemic times when everything - including payment systems - has gone digital. We have digital payments made from digital wallets, which are the ideal solution for safe online shopping in multiple currencies, offering virtual debit cards and, in some cases, using the buy now, pay later option.

The pandemic accelerated this transition on a larger scale, propelling payment innovations toward the next generation of solutions powered by artificial intelligence, blockchain, and other technology-powered advancements.

Governments are also enacting new regulations to address the threat posed by the expanding ecosystem of Central Bank Digital Currency (which is a digital version of cash). These safeguards are intended to make cross-border payments more secure for banks, merchants, and customers.

Read this article to learn more about the most important payment innovations we will see expand in 2023.

The key payment trends in fintech we'll go through are:

- Network tokenization

- Strong Customer Authentication (SCA)

- Biometrics

- Back-office integration

- Expansion of bank offerings

- Collaborations between banks and fintech startups

- Non-cash payments

7 payments innovations & trends in fintech for 2023

1. Network tokenization

The e-commerce scene is changing rapidly, and more stores are now following the subscription economy trend. This means that more sensitive card data than ever is going to be shared by customers via digital channels to complete payments and check out. That's why businesses need to take steps to secure this information. To deal with the increase in fraud, tokenization will become a common way to protect cross-border payment details - especially those made under different jurisdictions to the consumer location.

So, what exactly is network tokenization, and how will it help fight fraud?

Tokenization is a measure that safeguards the card number by replacing it with a unique string of numbers (token). The customer's sensitive card number will be substituted with a different token for every merchant. As a result, it's not going to be transmitted during the transaction, making the entire payment more secure.

Tokenization helps to combat fraud and protect trade finance liquidity. Even if hackers gain access to the system and steal tokenized data, they will be unable to process payments with the stolen tokens. This is because the token must be linked to the payment information securely stored by your payment partner/bank account provider.

It should be noted that network tokens will always function - even if payment card details are compromised, the token can still be used to pay for services, ensuring that consumers can continue to enjoy products without interruption.

2. Strong Customer Authentication (SCA)

Another key payment innovation in fintech and security measures that has continued to rise since 2020 is Strong Customer Authentication. Since the implementation of the second Payment Services Directive has been rolling out across Europe, certain transactions now require additional authentication for purchase. The deadline for addressing this regulation was set at the end of 2020, as set by the European Banking Authority.

This means that, while some banks gradually implemented SCA over the course of the first pandemic year, for others, becoming a bulletproof trader is now a requirement. Businesses must now invest in technologies that will allow them to apply SCA dynamically and ensure that digital payments are not declined due to inactive SCA measures.

3. Biometrics

In 2019, a UK bank issued the first biometric fingerprint credit card. Expect to see more of this type of payment innovation in 2023, particularly in mobile payments. Biometric authentication is now commonplace among consumers. Think of smartphones that use fingerprints and facial recognition to unlock. Biometric security is quickly becoming the new standard. As a result, providers will investigate new ways to improve the security of their services in response to new regulations as well as the increasing sophistication of fraud tactics.

This is where biometric data is going to play a key role.

3D Secure transactions, for example, include biometric authentication such as voice recognition and facial or fingerprint scans. Furthermore, technology can use the data collected during checkout to authenticate transactions without requiring the customer to do so repeatedly. As a result, financial institutions can improve the customer experience for strong authentication mobile transactions.

As merchants and banks look for new ways to prevent fraud, consumers should expect their personal features to become a secure way to pay.

4. Back-office integration

Most financial institutions have focused on front-end projects in recent years in order to acquire new customers, improve customer experience, and, ultimately, gain a competitive advantage. This frequently results in less focus on back-office digital transformation projects. As a result, many banks today rely on infrastructure and systems that separate customer data into silos, resulting in disconnected customer experiences. This will be a problem for banks looking to establish themselves as leaders in the new payments ecosystem.

Back-office optimization has become a new area of focus for many banks since 2020. Other factors driving back-office optimization include the need for real-time design so that payment systems can handle transactions 24/7 and the ability to simplify deployment and scalability by being cloud-ready. Several companies have already invested in optimizing their back office to prepare the banking system for future banking initiatives and allow third parties to integrate with their system seamlessly.

5. Expansion of bank offerings

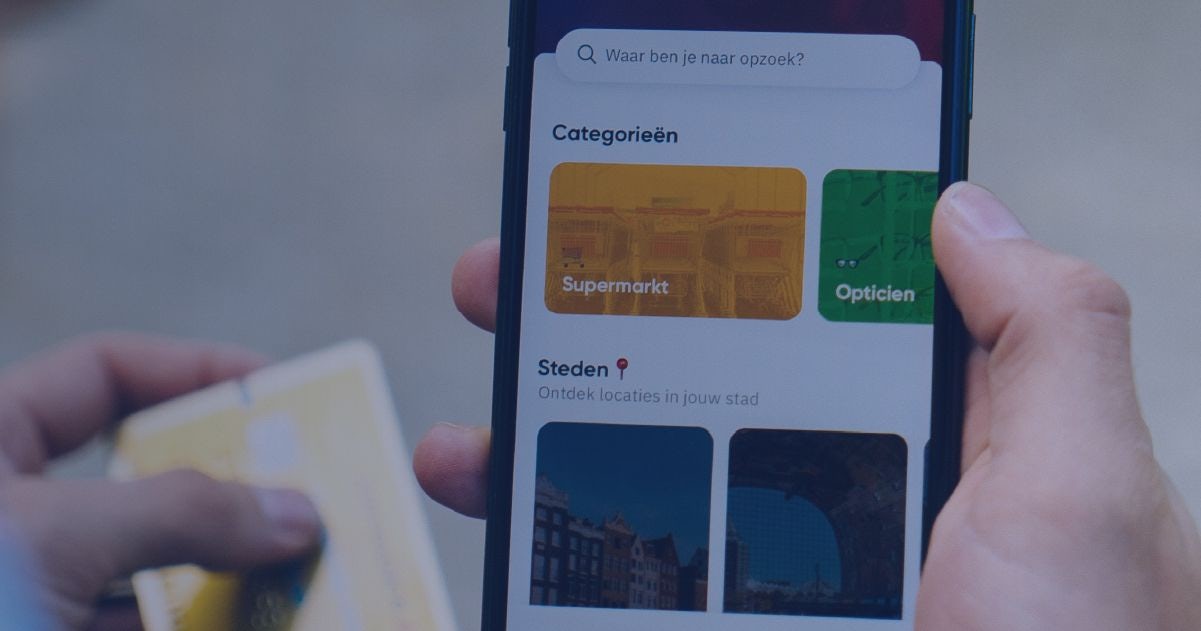

Merchants are starting to adopt alternative payment options, and card companies will do their best to adjust to the ever-changing consumer demand. Alternative payment solutions that offer real-time transaction capabilities are preferred among customers in an e-commerce context. That's why merchants are now offering more payment options than ever to cater to customers with different needs.

Alternative payment methods such as digital wallets, buy now pay later, and net-banking solutions have surpassed traditional payment methods such as credit (or debit) cards and cash. As a result, banks will develop smart point-of-sale solutions for merchants in 2023, allowing them to offer multiple payment options.

ING, for example, has begun testing a tap-on mobile app that converts mobile devices into point-of-sale terminals. Visa is collaborating with First Data and Samsung to develop a software-based system that will enable merchants to accept contactless payments of any amount on their handsets without the use of additional hardware.

To expand revenue streams and offer customers the best experience, financial institutions are predicted to continue investing in developing innovative point-of-sale devices that take advantage of alternative payments.

6. Collaboration between banks and fintech startups

Banks are going to become involved in even more targeted collaborations with fintech startups to improve their B2B payment interactions. After all, most payments innovation in trade finance is driven by startups and scale-ups.

Fintech companies have revolutionized the B2C payment space with many new payment offerings. That revolution has now led B2B companies to expect similar experiences from their service providers. That's why in 2023, we're going to see even more traditional banks collaborating with fintech startups to leverage their technological know-how, advanced data analytics, and machine learning capabilities to develop solutions in B2B with the use of distributed ledger technology, blockchain technology, embedded payments, and supplier financing.

For example, HSBC announced a $26 million investment in a fintech startup called Proactis to take advantage of its accelerated payment solutions and promote B2B payments to smaller suppliers.

In 2023, a growing number of corporate clients will expect sophisticated banking services such as efficient cash cycle management and improved data management. Collaboration with fintech startups will allow banks to provide tailored solutions to corporate customers.

7. Non-cash payments

Customers are increasingly moving away from cash payments (and traditional banks with physical locations). In 2023, a new set of alternative cashless payment methods will emerge to capitalize on this opportunity. Real-time payments via mobile wallets or QR code and the widespread adoption of bnpl services are going to become more significant than ever.

A large share of non-cash transactions still belongs to cards, but all these innovations are growing in terms of the number of transactions. Tech giants are also experimenting with different forms of contactless payments. For example, Amazon introduced cashier-less stores in the United States and plans to expand the concept globally, while another next-gen company, Apple, has already launched its own digital wallet.

Countries all over the world are catching on to this trend. For example, the Indian government recognizes the potential of digital transactions for transparency and encourages their growth. In order to encourage faster payments, India implemented the Unified Payments Interface in 2016.

Instant payments and the increased adoption of alternative payment methods will drive the growth of non-cash transactions. Note that emerging markets will become the leading adopters of cross-border payment trends thanks to the spread of technologies such as QR codes.

Payments innovations in fintech for 2023 - wrap up

The payments ecosystem is evolving at a rapid pace. In 2023, we're going to see the expansion of several trends that have resonated with consumers strongly during the Covid-19 pandemic. Needless to say, we may also see the emergence of brand-new trends that correspond to new customer payment expectations.

Do you need IT teams with experience in digital payment solutions? Get in touch with us, and let's talk about your project. Our teams have delivered such technologies to organizations operating in the financial services sector to help them deliver value to customers.