We can notice a kind of combination of two industries: financial and IT, which gives the current shape to the fintech sector.

This is because customers' requirements are also changing and are moving towards simplification. Technology is designed to provide convenience while adapting to real needs. Therefore, for example, the traditional banking format has to be either improved or replaced by new solutions. Because, who among us imagines making every transfer at the post office?

Fintech is an amazingly thriving sector that changes the way of life of millions of people so quickly that sometimes they do not even realize it.

The article will present the reasons why it is worth promoting the development of fintech and how Codete through advanced software solutions supports the financial and banking sector. On the basis of the case study, we will see step by step how these projects are powered by data science.

Let’s take a quick look at fintech history

The history of fintech development, according to most sources, dates back to the time when the Internet was founded. However, the real revolution began with the mass popularization of smartphones, that was after 2010.

It is worth noting that in every region of the world the fintech development model is different. Factors include access to capital, technology, regulatory barriers, legal environment, human resources and cultural determinants. However, in a nutshell, the main reasons for the development of the fintech sector include:

- access to the Internet and advanced communication technologies,

- legal and regulatory environment,

- potential and real demand for financial services.

Looking at the side of the digital revolution, we can see powerful changes in the functioning of current enterprises and institutions. In order to survive on the market, they have to face the competition that offers a new service model, new tools, often not covered by specific legal or tax regulations. All this makes it necessary to support specialists who will be able to make quick and effective changes in the company's technology.

At Codete, we are aware of the need for ongoing processes and prepared to implement new solutions. That's why we cooperate with multinational banks or global hedge funds by developing powerful systems for them. We support our operations with the latest achievements in enterprise technology.

Fintech companies are capable of quick and agile adaptation of new technologies, flexibly transforming them into new, valuable services. All this makes them find many loyal recipients in a relatively short time. Observing its development phase, we can already say that it shapes the current and future financial services market. It is innovative, and at the same time offers easy to use mechanisms, so it attracts more customers who have never used them before or used to a lesser extent.

Key fintech services that change reality

It is worth emphasizing that in the present reality the format of functioning international corporations also changes. Their domination, along with the growth of Internet users, began slowly to decline. Entrepreneurs who were able to notice and use technological development began to compete realistically in some areas with larger rivals. An innovative approach, an open mind and often taking risks allowed smaller players to achieve spectacular successes in business.

Each monopoly ends one day. The same applies to a dominance of many services that offered by large institutions. The possibility of using the Internet allowed the average person to access have so far been many resources and begun to be a part of the new community of users. This led to the development of fintech services such as:

- online payment service,

- e-banking and mobile banking,

- online insurance and loans,

- exchange offices,

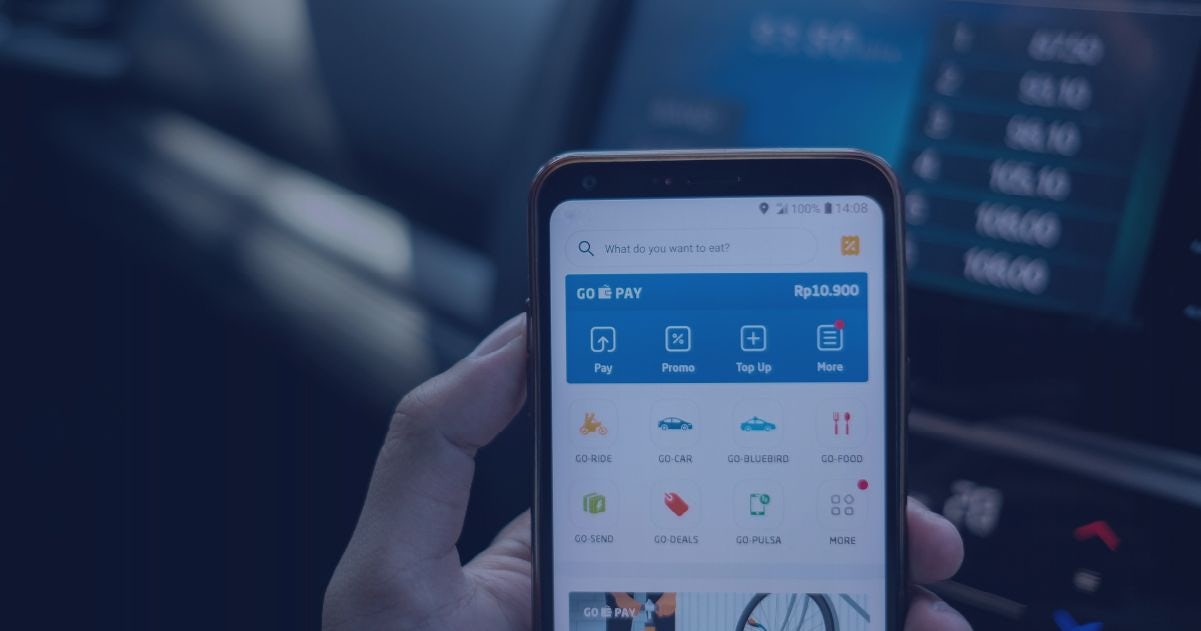

- mobile payment applications.

All these processes take place outside the traditional, previously known financial management. It is worth mentioning that many of them are not charged additionally in the form of a tax.

Fintech technology at Codete

At Codete, we believe that fintech has considerable potential to integrate financially, as well as counteract financial exclusion. All this takes place through low margins, innovation, simple optimization and scalability, as well as the lack of the need to invest in expensive assets.

The example above shows that fintech is not just a simple slogan, but a force that brings new financial opportunities that question current business models and regulations. It combines services along with more and more individualized technologies, often using large databases, as well as offering new forms of payment or virtual currencies (bitcoins). Additionally, it is worth paying attention to the high level of transactional and relational banking (B2B and B2C).

Fintech products are very often designed by online companies which are not affiliated with insurance institutions, banks or investment firms. However, they offer a lot of alternative ways of accessing the aforementioned services, from online transfers to comprehensive financial planning.

When making important decisions, banks increasingly use advanced analytical methods. The accumulated knowledge about their clients gives great opportunities to adjust individual offers. For this they need a huge amount of information, often from the outside, thanks to which they are adapting to the customer more and more. Using analytical methods such as Big Data, they can better locate the target group, set specific pricing policies, and manage the value of the recipient in the full cycle of its operation. They also use solutions like machine learning combined with artificial intelligence that allows virtual advisers to manage investment portfolios. It can be implemented to calculate and analyze cash flows and predict future scenarios.

At Codete, thanks to own R&D department, we are involved in multiple Big Data projects which let us be one step ahead in digital problem-solving worldwide.

Codete helps the strongest hedge funds players in fintech industry

To better understand the example, let's look at Codete's cooperation with an American financial company that specializes in the use of modern technologies such as artificial intelligence, machine learning, and distributed computing for creating hedge funds.

Our team have contributed to the crucial implementations and have ensured extensive IT consultancy since 2015. We are involved in building investor facing systems which allow their clients to manage their investment portfolio optimally and without the need of financial advisors support. The systems are divided into three main part and we are working exclusively for the hedge fund in backend and frontend technologies in an ongoing manner:

- The first one is a back-end service which major responsibility is to find a correlation between the factors and stock shares.

- The second one optimizes investor portfolio by the willingness to take risks, fluctuations, geographic preferences, industry knowledge, and many, many other variables provided by the user.

- The third and last tool that we develop is an environment for data scientists, well known and used widely as it’s an open source solution. We support our customer in many proof of concept project where we focus mostly on data science challenges.

And here comes the blockchain technology

Another example of technology that we implement to our fintech customers is blockchain technology. It covers mathematical, economic and cryptographic principles.

Thanks to such a combination, secure and distributed database can be run, divided into many participants, in which it’s not necessary to approve or agree entries by a third person. Generally speaking, it is a large decentralized and secure register through which transactions are made without intermediaries. It focuses on saving information in a data-resistant data structure that contains information about confirmed transactions.

Our specialists deal with the optimization of business processes through the exchange of data between entities with various economic goals. In order to fully understand the operation of this technology, one must possess cross-sectional knowledge from several different fields. However, the number of advantages is very large and it’s definitely worth investing in it.

The biggest one are:

- low transaction costs,

- mass level of trust and authorization of transactions,

- very high level of privacy protection,

- increase of global exchange of goods through digital technologies,

- transparent and verifiable system.

Because of blockchain, the financial sector can further develop thanks to the optimization of business processes. In front of our eyes, it’s changing the existing market, where entities with technologically advanced platforms are becoming more and more important.

Speaking of the advantages of blockchain technology, it is worth mentioning primarily the improvement of efficiency, due to elimination of the need of data reconciliation between different parties. In addition, the transaction settlement speed increases due to which existing financial processes are being rebuilt. A significant role is played by smart contracts - applications which under certain conditions, trigger the implementation of a specific operation. In practice, they can be used, for example, to transfer ownership of an apartment.

How we support blockchain implementation in business?

At Codete, we've devoted the last few years to blockchain technology research and development. We strongly believe that thanks to this technology we will be able to strengthen the security of our partners and help them increase the efficiency and create a transparent system.

The first such example is our cooperation with a leading US tech company (under NDA) which helps photographers protect their projects.

The idea of resolution depends on the licensing process where people from all over the world will get their share simultaneously in regard to the terms of the smart contract which is saved on licensing blockchain. Furthermore, it is the crucial point behind our marketplace where photographers can afford almost everything they need to do their job at the highest level (e.g.: hardware, software, travel, etc.).

Our digitized, decentralized blockchain ledger greatly simplifies store and access information. Thanks to that there is no need to go through a central authority such as a distributor. It ensures much more control over licensing and what should be underlined may lead to earning a bigger share of the license fee. It sets up proof of ownership and let platform to process license fees in real time using smart contracts. It leads to lending both trust and definitive control to copyright holders worldwide.

Codete success story with SatoshiPoint

Let’s take a look at cooperation with other great client - Satoshi Point. They are an operator of Bitcoin ATMs in the United Kingdom largest network of BTMs. The goal was to create the first BTM network with its own bitcoin wallet from the ground up.

Our project was based on creating an application for SatoshiPoint's BTM network with integrated machine location search. The application was able to assist classical wallet functionalities with all blockchain based transactions. It was done to improve user experience as well as maximize customers’ revenue.

What was the most crucial challenge identified by a customer? We had to ensure the highest possible level of security and anonymity for the user inside the system. Wanting to provide the highest quality of services while keeping these requirements in mind, Codete team provided development, consulting, security reviews and helped with getting the app into stores. We also took project management into account which allowed us to align with our customer’s demands while working as a standalone technology partner.

We also took action in the conceptual phase of development in order to tailor the right solution. It was one of the key moments to keep the transaction handling component completely separate. At the same time, data sent to server shouldn't allow for any fingerprinting. To meet customer requirements, we utilized the existing solution with new modules developed. We likewise covered the whole creation of server endpoint along with technical and security advisory. The whole technology process was very complex and required deep understanding of cryptocurrency-related mechanisms and hard skills in terms of payment systems implementation.

The above blockchain examples prove that the financial industry shows the greatest interest in the implementation of technology based on distributed registers due to the huge amount of dynamically changing data that it operates on a daily basis. However, seeing its widespread use, we can be sure that in the next few years more industries will implement the aforementioned solutions. This is good news for us who are ready to take up the challenge.

The reason why we are into financial industry

Using new technologies becomes a necessity in order to streamline processes. The solutions that AI, ML or blockchain offer become the market standard and no one disputes it. Taking all the above examples into account, we can see that investment in technology will contribute to savings, lowering operational risk, and gaining flexibility in managing production capacity.

The business transformation we are witnessing, in the face of technology, begins to create new concepts and transactional models. The latest trends contribute to changes in the economy, mobile solutions, cryptocurrencies, and scattered virtual registry. Those who want to be innovative must change their business model and use the links that modern technology offers. That's why it's crucial to know that powerful solutions require maximum focus on sustainability, efficiency and data safety. And that, we do know.

Don't hesitate to reach out to us if you're looking for a technology partner for your next project! We've got plenty of experience in delivering world-class fintech solutions.